Best Trading Platforms in UAE - Complete Guide for NRIs

The UAE trading landscape has exploded in 2025, with some striking statistics that every NRI should know (Sources at the end of the article):

Market Growth: UAE's stock exchanges now list over 390+ securities across DFM, ADX, and Nasdaq Dubai, with a combined market cap exceeding AED 3 trillion.

Digital Revolution: Emirates NBD just launched zero-fee local equity trading, while Interactive Brokers reported 40% growth in UAE accounts during 2024.

International Access: Top platforms now offer access to 150+ global markets, from NYSE to Tokyo Stock Exchange, directly from your Dubai apartment.

Cost Evolution: Trading commissions have dropped to as low as $1 per trade for US stocks, while local UAE stocks can be traded commission-free on select platforms.

But here's the number that matters most: 70-80% of retail traders lose money across all asset classes. The platforms are legitimate and regulated, but success depends entirely on your knowledge, discipline, and strategy.

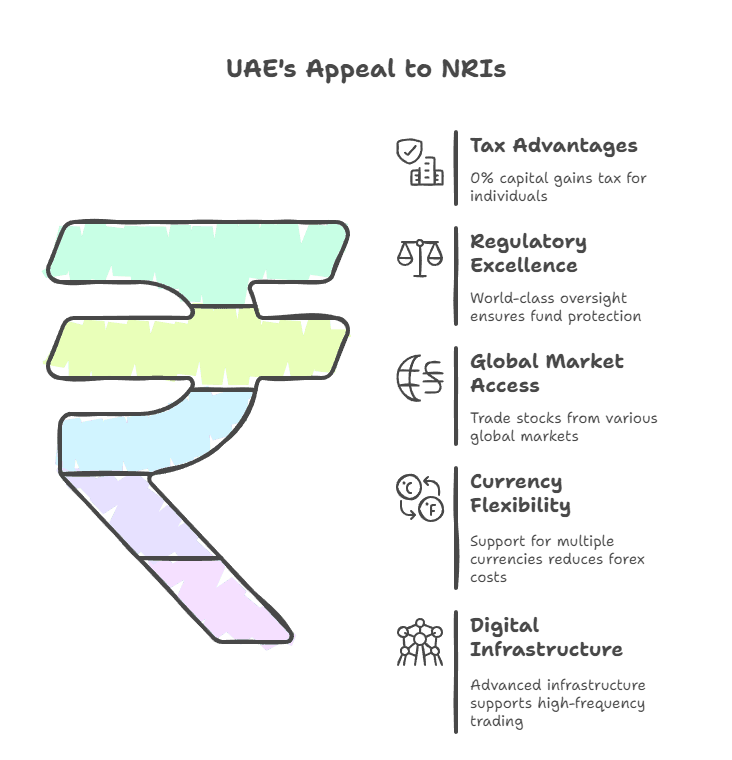

Why NRIs Are Flocking to UAE Trading Platforms

The appeal is obvious. UAE offers a unique combination that's hard to find elsewhere:

Tax Advantages: 0% capital gains tax on trading profits for individuals (corporate tax may apply to businesses above AED 375,000 profit).

Regulatory Excellence: World-class oversight through DFSA, SCA, and ADGM ensures your funds are protected from platform failures.

Global Market Access: Trade US stocks in the morning, European markets in the afternoon, and Asian markets in the evening – all from one platform.

Currency Flexibility: Most platforms support AED, USD, EUR, and GBP, reducing forex conversion costs.

Digital Infrastructure: UAE's advanced internet and banking infrastructure supports high-frequency trading and instant settlements.

The result? UAE residents now have access to some of the world's best trading platforms, with lower costs and better features than many developed markets.

Also Read: Best Forex Brokers in UAE

Understanding UAE's Trading Ecosystem

Local vs. International Platforms

UAE's trading landscape splits into two distinct categories:

Local Brokers (UAE-Licensed):

- Emirates NBD Securities, FAB Securities, ADCB Securities

- Direct access to UAE stock exchanges (DFM, ADX, Nasdaq Dubai)

- AED-denominated accounts and local banking integration

- Arabic customer support and UAE-specific features

- Regulated by Securities and Commodities Authority (SCA)

International Brokers (DFSA/ADGM Licensed):

- Interactive Brokers, eToro, Saxo Bank, XTB, IG Group

- Access to global markets including US, Europe, Asia

- Multi-currency accounts and advanced trading tools

- English-focused platforms with global customer bases

- Regulated by Dubai Financial Services Authority (DFSA) or Abu Dhabi Global Market (ADGM)

The National Investor Number (NIN) Requirement

To trade UAE stocks on DFM, ADX, or Nasdaq Dubai, you need a National Investor Number (NIN). Here's how it works:

Who Can Get a NIN: Any nationality, any country of residence

Cost: Free of charge

Processing Time: 2-3 working days through banks, instant through exchange apps

Validity: Permanent, no renewal required

Usage: Required for all UAE stock trading, IPO subscriptions

👉 Tip: Get your NIN through your bank when opening a trading account – they handle the paperwork automatically.

Top 10 Best Trading Platforms in UAE (2025)

1. Interactive Brokers - Best Overall Platform

Regulation: DFSA (Dubai) + SEC, FINRA (US)

Best For: Serious investors wanting global market access

Minimum Deposit: $0

Global Reach:

- 150+ markets in 33 countries

- 1.5 million products including stocks, bonds, ETFs, futures, options

- Access to NYSE, NASDAQ, LSE, Tokyo Stock Exchange, and more

- Professional-grade research and analysis tools

Cost Structure:

- US stocks: $1 per trade (minimum)

- International stocks: 0.05% of trade value

- Forex: $2 per $100K traded

- Options: $0.65 per contract

- No account maintenance fees

Advanced Features:

- Algorithmic trading and portfolio rebalancing

- Margin lending at competitive rates

- Tax optimization tools for international investors

- Real-time market data and professional charting

Why It Leads: Interactive Brokers combines institutional-quality tools with retail accessibility. Their global reach and low costs make them ideal for diversified portfolios.

2. eToro - Best for Social Trading

Regulation: ADGM/FSRA (Abu Dhabi) + FCA (UK), CySEC

Best For: Beginners wanting to copy successful traders

Minimum Deposit: $100

Social Trading Features:

- CopyTrader system to mirror top investors

- Social feed showing real trades and strategies

- Risk scoring for every trader you can copy

- Transparent performance history

Asset Coverage:

- 3,000+ stocks from 17 global markets

- 80+ cryptocurrencies

- Commodities, currencies, and indices

- Commission-free stock trading (spreads apply to CFDs)

Cost Structure:

- US stocks: 0% commission

- International stocks: 0% commission

- Crypto: 1-2% spreads

- Withdrawal fee: $5

- Currency conversion: 50-150 pips

Reality Check: While social trading sounds appealing, remember that past performance doesn't guarantee future results. Many copy traders lose money despite following "successful" investors.

3. Emirates NBD Securities - Best for UAE Stocks

Regulation: SCA (Securities and Commodities Authority)

Best For: UAE residents trading local stocks

Minimum Deposit: AED 3,000 minimum account balance

Local Market Advantages:

- Zero commission on UAE local equities (launched January 2025)

- Direct access to DFM, ADX, and Nasdaq Dubai

- Automatic NIN generation during account opening

- AED-denominated accounts with local banking integration

- Arabic customer support and UAE-specific research

Global Access:

- 11,000+ international stocks

- Access to Saudi Stock Exchange (Tadawul)

- Regional GCC markets

- Bonds and sukuk trading

Unique Features:

- T+0 settlement available (same-day cash from sales)

- THARAA' loyalty program with trading rewards

- Integration with Emirates NBD banking services

- IPO subscription through the same platform

Trading Channels:

- ENBD X mobile app

- Web-based trading platform

- Phone orders: +971 600 52 3434

- In-person trading at branches

4. Saxo Bank - Best for Research & Analysis

Regulation: DFSA (Dubai) + Multiple tier-1 regulators

Best For: Research-driven investors

Minimum Deposit: $0

Market Access:

- 70,000+ instruments across 120+ markets

- Comprehensive fixed income platform

- Advanced options and futures trading

- Structured products and warrants

Research Excellence:

- Daily market commentary and analysis

- Macro economic research reports

- Technical analysis tools

- Live market webinars and education

Platform Technology:

- SaxoTraderGO for beginners

- SaxoTraderPRO for advanced users

- Mobile apps with full functionality

- API access for automated trading

Cost Structure:

- US stocks: $3 minimum per trade

- European stocks: 0.10% minimum €4

- Forex: 0.7 pips EUR/USD

- No custody fees for most accounts

5. XTB - Best User Experience

Regulation: DFSA (Dubai) + FCA (UK), KNF (Poland)

Best For: Traders wanting intuitive platforms

Minimum Deposit: $0

Platform Excellence:

- xStation5 proprietary platform

- Exceptional mobile app design

- One-click trading functionality

- Advanced charting with 30+ indicators

Education Focus:

- Comprehensive trading academy

- Weekly webinars and market analysis

- Economic calendar integration

- Risk management education

Asset Range:

- 5,600+ instruments including stocks, ETFs, forex

- Fractional share trading available

- No minimum trade size

- Real stocks (not CFDs) in many jurisdictions

Competitive Pricing:

- 0% commission on real stocks and ETFs (up to €100K monthly volume)

- Tight spreads on CFDs

- No account fees or inactivity charges

6. Plus500 - Best for CFD Trading

Regulation: DFSA (Dubai) + Multiple tier-1 authorities

Best For: CFD traders and those wanting leverage

Minimum Deposit: AED 370 (~$100)

CFD Specialization:

- 2,800+ instruments as CFDs

- Leverage up to 1:30 (DFSA regulated)

- Guaranteed stop-loss orders

- Real-time risk management

Unique Features:

- Proprietary WebTrader platform

- No commission fees (spread-only pricing)

- Traders' Sentiment indicator

- Multi-chart viewing capabilities

Warning: CFDs are complex instruments with high risk. 82% of retail investor accounts lose money when trading CFDs with Plus500.

7. IG Group - Best for Advanced Trading

Regulation: DFSA (Dubai) + FCA (UK), multiple tier-1 authorities

Best For: Professional traders and advanced strategies

Minimum Deposit: $0

Advanced Features:

- 17,000+ markets available

- Advanced order types and risk management

- API access for algorithmic trading

- Professional charting with ProRealTime

Education Excellence:

- IG Academy with comprehensive courses

- Daily market analysis and insights

- Webinar series with expert traders

- Demo accounts with virtual funds

Cost Competitiveness:

- Competitive spreads across all asset classes

- No dealing desk on major markets

- Transparent fee structure

- Volume-based discounts available

8. FAB Securities - Strong Local Alternative

Regulation: SCA (Securities and Commodities Authority)

Best For: First Abu Dhabi Bank customers

Minimum Deposit: Account opening free

Local Focus:

- Direct access to ADX, DFM, Nasdaq Dubai

- Regional and international market access

- Integration with FAB banking services

- Arabic and English support

Service Features:

- Daily, weekly, monthly statements

- International trading agreements available

- Power of Attorney services

- Continued access when leaving UAE

9. Sarwa - Best Robo-Advisor

Regulation: DFSA (Dubai)

Best For: Hands-off investors wanting automated portfolios

Minimum Deposit: AED 18 (~$5)

Automated Investing:

- Robo-advisory with algorithm-based portfolios

- Automatic rebalancing based on market conditions

- Goal-based investing features

- Tax-loss harvesting

Investment Options:

- Diversified ETF portfolios

- Individual stock trading (Sarwa Trade)

- Crypto investment options

- Fractional share investing

Awards & Recognition:

- First regulated robo-advisor in MENA region

- Best Wealth Management Solution UAE 2025

- Reached profitability with strong customer growth

10. Pepperstone - Best for Forex & CFDs

Regulation: DFSA (Dubai) + ASIC (Australia), FCA (UK)

Best For: Forex traders and scalpers

Minimum Deposit: $0

Forex Excellence:

- Ultra-tight spreads from 0.0 pips

- Raw ECN pricing with transparent commissions

- High-speed execution with VPS hosting

- MetaTrader 4, MetaTrader 5, cTrader platforms

Global Recognition:

- Multiple "Best Forex Broker" awards

- Excellent customer support ratings

- Strong regulatory compliance record

Also read: Best Crypto Exchanges in UAE

Comparison of Best Trading Platforms in UAE

Platform | Regulation | Min Deposit | US Stocks | Global Markets | Mobile App | Best For |

|---|---|---|---|---|---|---|

Interactive Brokers | DFSA + SEC | $0 | $1/trade | 150+ markets | ★★★★☆ | Global portfolios |

eToro | ADGM + FCA | $100 | Free | 17 markets | ★★★★★ | Social trading |

Emirates NBD Securities | SCA | AED 3,000 | N/A | UAE + Regional | ★★★★☆ | UAE stocks |

Saxo Bank | DFSA + Multiple | $0 | $3/trade | 120+ markets | ★★★★☆ | Research |

XTB | DFSA + FCA | $0 | Free* | 16 markets | ★★★★★ | User experience |

Plus500 | DFSA + Multiple | $100 | CFDs only | 2,800+ CFDs | ★★★★☆ | CFD trading |

IG Group | DFSA + FCA | $0 | $8/trade | 17,000+ markets | ★★★★☆ | Advanced tools |

FAB Securities | SCA | Free | N/A | UAE + Regional | ★★★☆☆ | FAB customers |

Sarwa | DFSA | $5 | Limited | ETF portfolios | ★★★★☆ | Robo-advisory |

Pepperstone | DFSA + ASIC | $0 | CFDs only | Forex + CFDs | ★★★☆☆ | Forex trading |

*Subject to monthly volume limits

Getting Started: Step-by-Step Process

For UAE Stock Trading

Step 1: Choose Your Approach

- Bank-integrated: Emirates NBD Securities, FAB Securities (easier if you bank with them)

- Standalone: ADCB Securities or other independent brokers

- App-based: Use DFM app or iVestor app for instant account opening

Step 2: Gather Required Documents

- Emirates ID (for UAE residents)

- Passport and visa (for expatriates)

- Bank account statement (3 months)

- Salary certificate or employment letter

- Proof of address (utility bill or tenancy contract)

Step 3: Account Opening Process

- Apply online through broker's website or app

- Upload required documents

- Complete video KYC verification

- NIN will be generated automatically

- Initial deposit (varies by broker)

Step 4: Platform Setup

- Download mobile app or access web platform

- Set up security features (2FA, PIN, biometrics)

- Explore demo features before live trading

- Connect to local bank account for funding

For International Trading

Step 1: Platform Selection

- Beginners: Start with eToro for social features and education

- Experienced: Choose Interactive Brokers for comprehensive access

- Research-focused: Consider Saxo Bank for analysis tools

Step 2: Account Opening

- Complete online application (usually 10-15 minutes)

- Upload Emirates ID and additional documentation

- Pass regulatory questionnaire about trading experience

- Verify identity through video call if required

Step 3: Funding Your Account

- Bank transfer from UAE account (most cost-effective)

- Credit/debit card (faster but higher fees)

- International wire transfer (for larger amounts)

- Some platforms accept digital wallets

Step 4: Start Trading

- Begin with demo accounts to learn platform features

- Start with small position sizes

- Focus on liquid, well-known stocks initially

- Use educational resources provided by brokers

Understanding the Costs: Hidden Fees You Must Know

Trading Commissions

Free Trading Reality Check: Many platforms advertise "commission-free" trading, but costs are built into spreads or other fees.

Local UAE Stocks:

- Emirates NBD Securities: 0% (promotional offer launched January 2025)

- FAB Securities: 0.25-0.30% of transaction value

- ADCB Securities: Similar to industry standard ~0.30%

US Stocks:

- Interactive Brokers: $1 minimum per trade

- eToro: $0 commission (spreads on CFDs)

- Saxo Bank: $3 minimum per trade

- XTB: $0 up to €100K monthly volume

Currency Conversion Costs

The Hidden Expense: Converting AED to USD, EUR, or other currencies can cost 0.5-2% per transaction.

Minimize Conversion Costs:

- Maintain multi-currency accounts where possible

- Use platforms offering competitive FX rates

- Consider currency hedging for large positions

Account Maintenance and Inactivity Fees

Watch Out For:

- Monthly account fees: $0-$20 (varies by platform and account type)

- Inactivity fees: $50-$100 per year after 12+ months of no trading

- Data fees: $1-$30 per month for real-time market data

- Withdrawal fees: $5-$25 per withdrawal

Platform-Specific Fee Comparison

Platform | Account Fee | Inactivity Fee | Data Fee | Withdrawal Fee |

|---|---|---|---|---|

Interactive Brokers | $0 | $20/month | $1-$30/month | $0 |

eToro | $0 | $10/month | Free | $5 |

Emirates NBD Securities | AED 3,000 min balance | $0 | Free | Free |

Saxo Bank | $0 | €100/year | Free basic | Free |

XTB | $0 | €10/month | Free | $0 |

Regulatory Landscape and Safety

UAE's Multi-Tiered Regulation

Securities and Commodities Authority (SCA): Regulates mainland UAE brokers and stock exchanges. Ensures client fund segregation, capital adequacy, and operational standards.

Dubai Financial Services Authority (DFSA): Oversees DIFC-based international brokers. Enforces strict compliance with global best practices.

Abu Dhabi Global Market (ADGM): Regulates financial services in Abu Dhabi's financial free zone through FSRA.

Central Bank of UAE: Provides overall financial system oversight and anti-money laundering enforcement.

Investor Protection Measures

Fund Segregation: Client money must be held separately from broker operational funds.

Capital Requirements: Brokers must maintain minimum capital to ensure financial stability.

Auditing and Reporting: Regular financial audits and transparent reporting to regulators.

Complaint Mechanisms: Formal processes for dispute resolution between investors and brokers.

Important Note: UAE doesn't have deposit insurance like FDIC (US) or FSCS (UK), but strong regulation significantly reduces platform risk.

The Risks Nobody Talks About

Market Risk (The Big One)

Volatility Reality: Stock markets can lose 20-50% of value during corrections. Even "safe" blue-chip stocks experience significant fluctuations.

Sector Concentration: UAE stock market is heavily weighted toward real estate, banking, and energy. Lack of diversification increases risk.

Liquidity Issues: Some UAE stocks have low trading volumes, making it difficult to buy/sell large positions without affecting prices.

Platform and Technology Risks

System Outages: Even the best platforms experience downtime during high-volatility periods when you most need access.

Execution Risk: During rapid market moves, your orders may not execute at expected prices due to slippage.

Cyber Security: Trading platforms are attractive targets for hackers. Strong passwords and 2FA are essential.

Behavioral and Psychological Risks

Overconfidence Bias: Early profits often lead to overconfidence and larger, riskier bets that destroy accounts.

FOMO Trading: Fear of missing out drives people into investments at peak prices before corrections.

Emotional Decision Making: Panic selling during downturns and euphoric buying during uptrends consistently destroy wealth.

Time Commitment: Successful trading requires significant time for research, monitoring, and analysis.

Tax and Compliance Risks

Record Keeping: You must maintain detailed records of all transactions for potential tax obligations in your home country.

Reporting Requirements: US citizens must report foreign accounts and investments to IRS regardless of UAE tax treatment.

Changing Regulations: Tax laws and trading regulations can change, affecting your investment strategy.

Better Alternatives for Most NRIs

While researching UAE trading platforms, I've noticed a concerning pattern: many NRIs are using these excellent platforms to speculate rather than build long-term wealth.

For Systematic Wealth Building

Instead of trying to time UAE or global stock markets, consider systematic investment approaches:

NRI mutual fund investments offer professional management, diversification, and historically strong returns without requiring daily market monitoring.

Systematic Investment Plans (SIPs) remove the guesswork from market timing by investing fixed amounts regularly regardless of market conditions.

For Currency Protection Without Market Risk

Many NRIs trade currencies trying to hedge AED/INR risk. A safer approach:

GIFT City USD fixed deposits provide guaranteed returns in USD with full repatriation flexibility and zero market risk.

Current rates exceed 5% annually with complete principal protection – better than most trading outcomes without the stress.

For Guaranteed Income Generation

NRE fixed deposits currently offer up to 7.3% p.a. tax-free returns with government backing.

This guaranteed return often exceeds what most traders achieve after accounting for losses, taxes, and time invested.

For Long-term Wealth Creation

Diversified NRI investment portfolios combining equity, debt, and real estate provide better risk-adjusted returns than individual stock picking.

Professional portfolio management removes emotional decision-making while maintaining growth potential.

👉 Tip: The most successful NRIs I counsel allocate 80-90% to proven wealth-building strategies and only 10-20% to active trading or speculation.

Final Recommendations

After analyzing every major trading platform in UAE, here's my honest assessment for different investor types:

For Serious Long-term Investors

Choose Interactive Brokers for comprehensive global access, low costs, and professional tools. Their regulatory standing and institutional-quality platform justify slightly higher complexity.

For Social and Copy Trading

eToro remains unmatched for beginners wanting to learn from others. But remember: copying others' trades doesn't guarantee profits.

For UAE Stock Focus

Emirates NBD Securities offers the best local market access with zero fees on UAE equities and seamless banking integration.

For Research-Driven Investing

Saxo Bank provides exceptional analysis and market research that can improve your investment decisions.

For Most NRI Wealth Building

Consider proven alternatives like systematic mutual fund investing, GIFT City USD deposits, or diversified NRI portfolios instead of trying to beat the market through trading.

The Reality Check: Trading platforms are tools, not solutions. They provide access to markets, but success depends entirely on your knowledge, discipline, and strategy. Most retail traders lose money regardless of which excellent platform they use.

My Recommendation: Use these platforms for long-term investing in diversified portfolios rather than short-term trading. Dollar-cost average into broad market ETFs, hold for decades, and focus on building wealth through career advancement and systematic saving.

The best trading platform is often the one you use least frequently for the most boring investments.

Ready to explore systematic wealth building instead?

Join our WhatsApp community where 2,000+ NRIs discuss proven investment strategies that don't require daily market monitoring. Plus, download our app to explore USD fixed deposits in India's GIFT City – our users prefer predictable 5%+ returns over the stress of daily trading.

Sources

StashAway UAE Trading Platform Analysis, Virtuzone UAE Trading Guide, Business24-7 Stock Broker Review, Dubai Financial Market Official Guide, Emirates NBD Securities Platform, Securities.io UAE Broker Analysis, Abu Dhabi Securities Exchange Information

Comments

Your comment has been submitted